Which is the best choice? Employ a bookkeeper or outsource it to an accounting firm? Read more about it here.

A single bv can be a good choice for start-ups or small businesses with limited risks. But as your business grows, you carry out multiple activities or want to protect assets, a more elaborate structure becomes more interesting. In such cases, a holding bv or management-bv offers several advantages in terms of risk diversification, tax optimization and flexibility. Yet this does not always have to mean setting up separate entities. In fact, the activities of a holding or management bv can often be carried out within the same bv.

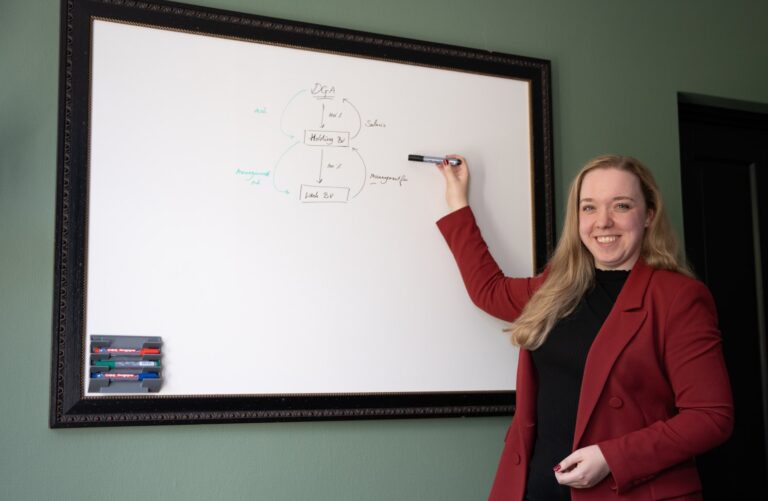

A holding bv acts as a parent company and owns the shares of one or more operating companies. The operating companies are responsible for day-to-day business activities, such as providing products or services, while the holding company focuses on managing assets, such as profit reserves, investments or shares.

A management bv is a specific variant of a holding bv, in which you as entrepreneur structure your activities. Through your management bv, you carry out activities for an operating company or other clients. This can be useful if, as director and major shareholder (DMS), you provide services to several companies or if you operate within a group structure.

It is important to note that the activities of a holding or management company can often be combined in one bv. For example, a holding bv can carry out business activities itself or perform a management function. This saves administrative burdens and formation costs. Only in specific circumstances, such as wanting to separate high risks, setting up multiple entities may be wise.

At higher profits

If your company is structurally profitable, a holding structure can be attractive. The profit you do not need immediately can be transferred tax-free to the holding company and reserved for future investments or as a buffer.

If you want to mitigate risks

Do you work in an industry with high financial or legal risks? Then it makes sense to protect your assets with a holding company. Placing assets such as savings or real estate in the holding company will keep them out of reach of creditors in case of problems at the operating company.

In case of multiple business activities

If you carry out different types of activities, it may be convenient to separate them into separate operating companies. But if the risks are limited, you can also consider having these activities under the same bv.

If you want to expand or sell shares

Do you have plans to expand or sell shares? A holding bv allows you to add or divest operating companies more easily, while keeping your holding and other activities intact.

For self-employed professionals with multiple clients

If you are self-employed and have multiple clients, a management bv offers tax advantages and protection. This can also be set up within one bv in some cases.

Establishing a holding company structure requires a well thought-out plan and the right legal steps, such as incorporation through a notary. But if the functions of a holding company and management bv fit into one bv, it can be simpler and more advantageous

At Belastingadviseur Eindhoven B.V. we are happy to help:

A holding or management structure offers many advantages, but a single bv can also suffice in many situations. Together with you, our team will look at your needs and possibilities and provide tailor-made advice. Please contact us and discover how we can optimise your company's tax and legal structure!

Which is the best choice? Employ a bookkeeper or outsource it to an accounting firm? Read more about it here.

What is the role of a shareholders' agreement and why should you include it when setting up a bv? Read more about it here.

Read here what you need to consider when setting up a bv with a foreign shareholder.

Belastingadviseur Eindhoven is onderdeel van Adviesgroep Eindhoven. De one-stop-shop voor ondernemers, particulieren en expats.

Om de beste ervaringen te bieden, gebruiken wij technologieën zoals cookies om informatie over je apparaat op te slaan en/of te raadplegen. Door in te stemmen met deze technologieën kunnen wij gegevens zoals surfgedrag of unieke ID's op deze site verwerken. Als je geen toestemming geeft of uw toestemming intrekt, kan dit een nadelige invloed hebben op bepaalde functies en mogelijkheden.